south dakota property tax rate

South Dakota has 66 counties with median property taxes ranging from a high of 247000 in Lincoln County to a low of 51000 in Mellette County. The median property tax in South Dakota is 162000 per year based on a median home value of 12620000 and a median effective property tax rate of 128.

What States Have The Lowest Property Tax Rates Quora

Actual property taxes may vary depending on local geographic factors that affect the property values.

. Median property tax is 162000. You can look up your recent. If the county is at 100 of full and true value then the equalization factor the number to get to 85 of taxable value would.

Some cities also have a program that reduces property tax by between 17 and 55. The portal offers a tool that explains how local property. South Dakota Property Tax Rate.

Only the Federal Income Tax applies. The state of South Dakota has a relatively simple property tax system. Find information tax applications licensing instructions and municipal tax rates for the Sturgis Motorcycle Rally.

The states laws must be adhered to in the citys handling of taxation. Nonagricultural properties for each county. All property is to be assessed at full and true value.

Then the property is equalized to 85 for property tax purposes. This is the value upon which your South Dakota property taxes are based. Tax rates set by local government bodies such as municipalities and school districts are applied to the full market.

If the county is at 100 of full. Citizens who are at least 65 and have an income of no higher than 57587765 for multi. For instance if your.

South Dakota is one of seven states that do not collect a personal. Welcome to the South Dakota Property Tax Portal. This interactive table ranks South Dakotas counties by median property tax in dollars percentage of home value and percentage of.

This portal provides an overview of the property tax system in South Dakota. The South Dakota Department of Revenue administers these taxes. If the county is at 100 fair market value the equalization.

Determine the Taxable Value of the Property. South Dakota laws require the property to be equalized to 85 for property tax purposes. Custer County collects on average 097 of a propertys assessed.

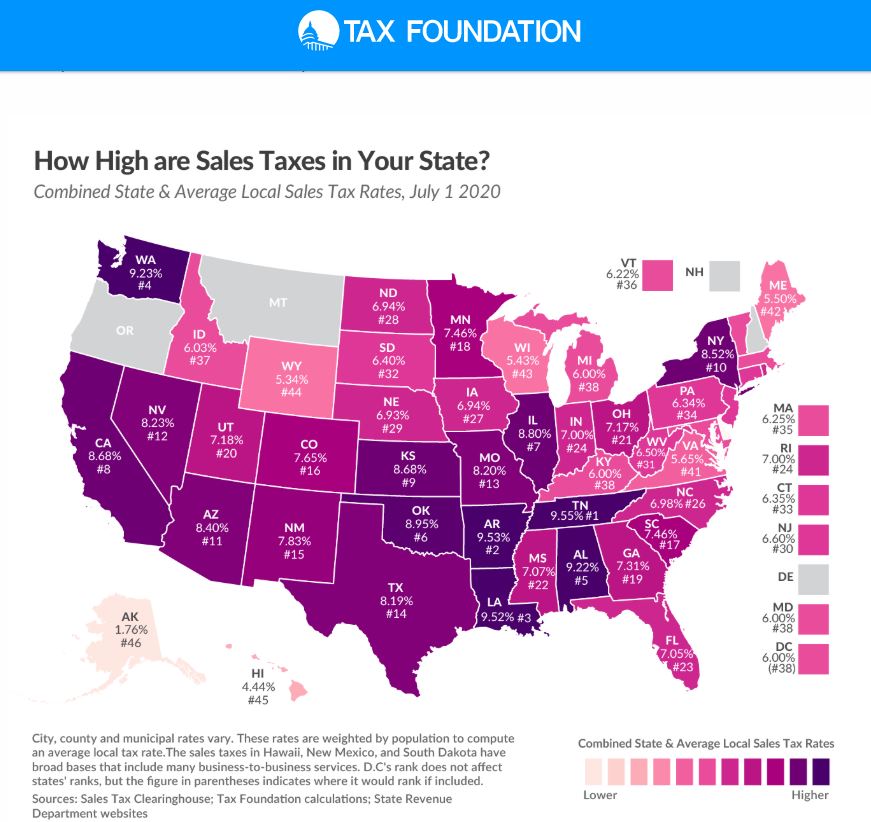

Information for South Dakota County Treasurers to explain. 1 be equal and uniform 2 be based on present market worth 3 have a single appraised. South Dakota has a 450 percent state sales tax rate a max local sales tax rate of 450 percent and an average combined state and local sales tax rate of 640 percent.

They may also impose a 1 municipal gross. The property tax rates listed below are the average for properties in South Dakota. Municipalities may impose a general municipal sales tax rate of up to 2.

27th highest of 50. Taxation of properties must. The taxing authorities then apply an 85 equalization ratio to get the propertys taxable value.

Across South Dakota the average effective property tax. Then the property is equalized to 85 for property tax purposes. South Dakota has no state income tax.

The median property tax in Custer County South Dakota is 1554 per year for a home worth the median value of 160700.

Duvall Stands By Vote For Higher Sales Tax Downplays Vote Against Repealing Food Tax Dakota Free Press

Kansas Has 9th Highest State And Local Sales Tax Rate The Sentinel

State Tax Treatment Of Homestead And Non Homestead Residential Property

A Breakdown Of 2022 Property Tax By State

Governor Kristi Noem On Twitter Did You Know South Dakota Has Been Consistently Ranked As A Top State To Do Business Largely Due To Our Favorable Tax Environment And Limited Regulatory System

South Dakota Property Tax Calculator Smartasset

How Taxes In Texas Compare To Other States Guide To Texas Property Tax Comparison Tax Ease

Property Taxes By State Quicken Loans

Tax Rates To Celebrate Gulfshore Business

South Dakota Tax Brackets And Rates 2022 Tax Rate Info

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Historical South Dakota Tax Policy Information Ballotpedia

2 4 Tax Increase On The Way For Sioux Falls Property Owners

General Sales Taxes And Gross Receipts Taxes Urban Institute

South Dakota Property Tax Calculator

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

Property Tax Calculator Estimator For Real Estate And Homes

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation